A Guide to Capital Gains Tax on Property: Insights for Homeowners and Investors

January 13, 2024 . Home Buyer's Guide . 10 min readIn the intricate landscape of real estate transactions, one aspect that commands careful consideration is the capital gains tax on property. As homeowners and investors navigate the nuances of buying and selling, understanding the intricacies of this tax becomes paramount. This comprehensive guide aims to shed light on various facets of capital gains tax, offering valuable insights for informed decision-making. From fundamental concepts to practical strategies, we embark on a journey to unravel the complexities surrounding this crucial element in property transactions. So, let’s delve into the world of capital gains tax on property, examining its core components and unveiling the strategies that can empower individuals in their pursuit of optimal financial outcomes.

What is Capital Gains Tax on Property?

Capital gains tax on property is a levy imposed on the profit gained from the sale of a property. Understanding the intricacies of capital gains tax on property is fundamental for anyone involved in real estate transactions. Whether you’re a homeowner planning to sell your residence or an investor venturing into the real estate market, being well-versed in the basics of this tax ensures that you can navigate the complexities of property transactions with confidence and financial acumen.

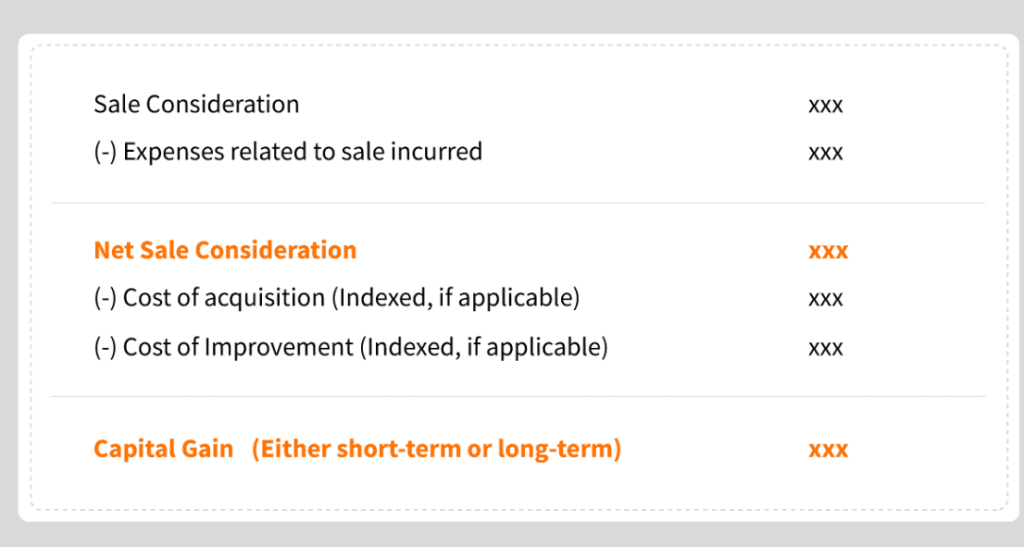

The calculation of capital gains tax depends on various factors like the type of asset sold, holding period, applicable tax rate, and any exemptions claimed. Here’s a breakdown of the process:

1. Determine the Capital Gain:

- Sale Price: This is the amount you receive when you sell the asset.

- Cost of Acquisition: This is the original purchase price of the asset, including any incidental expenses like broker fees or registration charges.

- Improvement Costs: Any expenses incurred for improvements on the asset during ownership can be added to the cost of acquisition.

- Capital Gain: Subtract the cost of acquisition and improvement costs from the sale price. This amount is your capital gain.

2. Identify the Holding Period:

Short-Term Capital Gain (STCG): This applies to assets held for less than 24 months.

Long-Term Capital Gain (LTCG): This applies to assets held for 24 months or more.

3. Apply Tax Rate:

STCG: Generally taxed at a higher rate than LTCG, depending on your income slab. In India, it’s currently 15%.

LTCG: Typically has a lower tax rate than STCG. In India, it’s currently 20% if the capital gain exceeds Rs. 1 lakh.

4. Consider Exemptions:

Certain sections of the Income Tax Act offer exemptions from capital gains tax under specific conditions. For example, Sections 54 and 54F offer exemptions for reinvesting the proceeds from a property sale into a new residential property within specified timeframes.

5. Calculating the Tax:

Multiply the capital gain by the applicable tax rate to determine the capital gains tax payable. For example, if you sell a property for Rs. 1 crore after holding it for 3 years (LTCG), and your LTCG tax rate is 20%, your capital gains tax would be Rs. 20 lakh (1 crore * 20%).

What is Long-Term Capital Gains Tax (LTCG)?

Long-Term Capital Gains Tax (LTCG) in the Indian context pertains to the taxation of profits derived from the sale of a capital asset, such as real estate property. To qualify for LTCG treatment, the property must be held for a period exceeding two years before being sold. This extended holding duration, a distinctive feature in Indian taxation, sets LTCG apart from Short-Term Capital Gains Tax (STCG) and is accompanied by more favorable tax rates.

The underlying principle is to reward long-term investors with a potential tax advantage. As of now, the LTCG tax rate stands at 20% for capital gains tax on property in India. This flat rate includes the basic tax rate, and indexation is allowed to adjust the cost of acquisition for inflation. This indexation provision not only aligns with the government’s efforts to encourage long-term investments but also provides individuals with a strategic approach to managing their tax liabilities.

What is Short-Term Capital Gains Tax (STCG)?

On the flip side, Short-Term Capital Gains Tax (STCG) comes into play when a property is held for 2 years or less before being sold. This implies that gains from the sale of the property are subject to taxation at your regular income tax slab rate, without indexation. The tax rate is aligned with your individual income tax bracket, making it crucial for investors to be mindful of the potential tax implications related to capital gains tax on property.

Additional Insights into Capital Gains Tax Management on Property Transactions

- Tax Implications of Selling a House

When venturing into property transactions, it’s crucial to grasp the tax implications associated with selling a house. Capital gains tax on property is a significant component of this equation. As mentioned earlier, LTCG rates currently stand at 20%. However, the intricacies deepen for high-value transactions. If the sale proceeds surpass 2 crore, an additional surcharge of 15% and a 4% cess are levied, injecting a layer of complexity into the tax calculation. Recognizing these nuances becomes imperative for individuals seeking to optimize their financial outcomes in property sales.

- Benefits of Reinvesting in a New Property

To mitigate a substantial portion of capital gains tax on property, a savvy strategy is to reinvest the capital gain (not the entire sale proceeds) in a new property. This approach allows for the deferral of tax liability while ensuring that the remaining funds are still available for use. Beyond merely preserving capital, investors can strategically utilize the remaining funds, unlocking opportunities for further growth or meeting other financial objectives.

- Tax Liability and Available Funds Example

Let’s illustrate this with a hypothetical scenario:

Selling Price of the House: ₹5 Crore

Purchase Price of the House: Let’s assume ₹2 Crore

Your Capital Gain = Selling Price – Purchase Price

Capital Gain Amount = ₹5 Crore – ₹2 Crore = ₹3 Crore

LTCG Tax = 20% of ₹3 Crore = ₹60 Lakhs

Now, if you want to save on LTCG tax by buying a new house, you need to invest the entire LTCG amount of ₹3 Crore in the new property. This strategic move allows you to defer the tax payment on the entire capital gain, ensuring you won’t have to bear the cost of ₹60 Lakhs, thereby maximizing the funds available for your new property investment.

If you choose to reinvest only let’s say ₹2 Crore out of the total LTCG amount of ₹3 Crore, you will be eligible for exemption on the invested amount (₹2 Crore) under Section 54 of the Income Tax Act. However, the remaining ₹1 Crore would not be invested and would be subject to LTCG tax at the rate of 20%.

Relationship Between Income and Tax Rates

The pivotal relationship between an individual’s income and the applicable tax rates significantly influences capital gains tax on property transactions. As capital gains contribute to one’s overall income, it becomes imperative to comprehend how this impacts tax liabilities. Higher-income levels often correlate with increased tax rates, directly influencing the amount owed on capital gains. Understanding this relationship empowers individuals to adopt strategic tax optimization strategies tailored to their specific financial situations.

Tips to Reduce Capital Gains Tax on Property

- Reinvest in a Residential Property

Under Section 54 of the Income Tax Act in India, homeowners can claim an exemption from capital gains tax on property by reinvesting the proceeds from the sale of one property in another residential property within a specified time frame.

Case 1: If you plan to buy a new residential property, you need to do so within one year before the sale or within two years after the sale of the original property.

Case 2: If you choose to construct a new residential property, the construction must be completed within three years from the date of the sale of the original property.

This avenue not only preserves capital but also aligns with the government’s initiatives to promote residential property ownership.

- Invest in Capital Gains Bonds

Claiming exemption from Long-Term Capital Gains Tax (LTCG) and thereby strategically managing capital gains tax on property, can be achieved under Section 54EC by investing in specific bonds issued by institutions like the National Highways Authority of India (NHAI) or the Rural Electrification Corporation (REC). However, you must make the investment within six months from the date of sale of the property. The six-month countdown commences on the date of the property sale, during which you must allocate the funds into the specified bonds to qualify for the LTCG exemption. This means if you sell your property on January 20, 2024, your deadline to invest in capital gains bonds would be July 20, 2024. The bonds have a lock-in period of five years, meaning you cannot redeem them before that period is complete. Thus, this strategy provides an alternative avenue for capital deployment while mitigating tax liabilities.

- Joint Ownership or Co-ownership

Co-owning or jointly purchasing a property proves beneficial not only during ownership but also at the time of sale, providing an insightful strategy for managing capital gains tax on property. Distributing capital gains between co-owners allows for a more equitable distribution of tax liability, presenting a strategic advantage in optimizing overall financial outcomes.

The time limit for claiming the exemption under Section 54 still applies: one year before or within two years after the sale.

- Capital Gains Account Scheme

In cases where immediate reinvestment isn’t feasible, navigating the complexities of capital gains tax on property finds a solution in the Capital Gains Account Scheme, 1988. By depositing the capital gains amount in a designated ‘capital gains account’ in an authorized bank, individuals can avail of tax exemption, with a maximum deposit limit of Rs. 10 crores, as specified under Sections 54 and 54F of the Income Tax Act. Nevertheless, if the funds deposited in the Capital Gains Account Scheme remain unused beyond the specified timeframe, they will be treated as income for the year in which the 3-year period elapses from the date of selling the original property.

- Deposit Time Limit: The amount needs to be deposited in the capital gains account within 6 months from the date of selling the property before the income tax return filing deadline.

- Utilization Time Limit: The capital gains amount deposited in the account must be utilized for the purchase or construction of a new property within the specified time frames mentioned under Sections 54 and 54F of the Income Tax Act:

- Section 54: The time limit for the purchase of a new residential property is indeed one year before or within two years after the sale of the original residential property. In the case of the construction of a new residential property, the time limit is three years after the sale of the original residential property.

- Section 54F: If you sell an asset other than a residential property and wish to claim an exemption, you must reinvest the entire proceeds in a new residential property. The time limit applicable is one year before or within two years after the sale of the original asset if you choose to purchase the new residential property. Within three years after the sale of the original asset, if you choose to construct the new residential property.

Consequences for Non-Compliance:

- Reinvestment Failure: If the individual does not reinvest the capital gains amount in another residential property as per the specified time frames (one year before or two years after the sale, or three years for construction), the exemption claimed under Section 54 and Section 54F will be disallowed.

- Taxation of Capital Gains: The unutilized capital gains amount, which was earlier exempted, will be considered taxable in the year in which the specified time frame lapses.

Calculation of Taxable Capital Gains:

Taxable Capital Gains = Original Capital Gains − Exempted Amount

Conclusion

Navigating the landscape of capital gains tax on property demands a strategic approach. By understanding the nuances of long-term and short-term tax rates, exploring avenues such as reinvestment, bonds, and joint ownership, and leveraging benefits like indexation, individuals can optimize their financial outcomes. The key lies in informed decision-making, utilizing available exemptions, and adhering to proper documentation. With these insights, property transactions can be approached with confidence, ensuring not only compliance with tax regulations but also maximizing the retained value from the sale.