Chapter 2: Assessment of your financial situation

April 2, 2019 . Home Buyer's Guide . 10 min readBefore going for a home loan, it is necessary to determine one’s financial situation as to how much down payment an individual can make and how much amount one can afford as Equated Monthly Instalment (EMI). Such an assessment will determine the effectiveness of your home loan investment.

This financial situation assessment is also used to determine how much and for how long one’s assets can cover for the EMIs if the regular income suddenly stops for some unforeseen reasons.

We have a 4-step process to determine your home budget:

- Estimating your net worth

- Estimating your home budget

- Home loan eligibility

- Cover

Estimating your net worth

This assessment is done by considering all the assets & liabilities of a family.

Assets

- Cash & Cash Equivalents like Savings Account, Fixed Deposits

- Family Investments (Mutual Funds, Equities, Insurances, Bonds, Certificate of Deposits)

- Home value

- Durable Goods & Automobile

- Gold, Jewellery, etc.

- Retirement Accounts such as Pension & Provident Fund (PF)

Liabilities

- Home Loan

- Car Loan

- Student Loan

- Personal Loan

- Gold Loan

- Credit Card

- Taxes

A family’s Net Worth is defined as the difference between its total assets and total liabilities:

Net Worth = Total Assets – Total Liabilities

Estimating your home budget

As you prepare for home ownership, it is important to make informed & responsible decisions about your financial situation. Although banks perform a detailed assessment of your financial situation before giving you a home loan, they tend to ignore certain expenses that consume your disposable income such as your grocery expenses and medical bills, among others.

By doing your own affordability check, you can be sure that you don’t borrow more than you can actually afford. The following factors should be considered while estimating your home budget:

Net household income after tax – Total net income from all the earning members of the family who contribute towards paying household expenses. You should consider the income from all the sources such as commissions, bonuses and investments, among others.

Some of these items could be –

- Sum of all the monthly family income for the year

- Income from interests on savings account, FDs and Bonds, among others

- Capital gains on selling equities, mutual funds and gold

- Dividends

- Gratuity

- Bonuses, fees and commissions

Monthly household expenses – Your expenses on groceries, the bills you pay every month such as electricity, gas bill, telephone & broadband bills and credit card bills; medical expenses, education expenses on your child and your lifestyle expenses that you can try to minimise.

Some of these items could be –

- Sum of monthly utility expenses for the year

- Sum of monthly food & groceries expenses for the year

- Annual healthcare expenses

- Annual premium towards life insurance and medical insurance

- Sum of monthly rental paid for the year

- Education

- Transportation

- Eating out & shopping

Monthly fixed obligations – The monthly fixed obligations include your credit card bills, EMI towards car loan, personal loan and education loan and the insurance premiums.

Consider that your monthly income from all the sources is ₹1 lakh. Your monthly household expense including the rent is ₹30,000. You have a car loan, where you are paying a monthly EMI of ₹10,000. So, your monthly disposable income comes to ₹60,000 which can be used towards home buying.

| Income | ₹1,00,000 |

| Expense (-) | ₹30,000 |

| Obligation: Car Loan (-) | ₹10,000 |

| Net Disposable Income | ₹60,000 |

Home loan eligibility

Your home loan eligibility amount is decided with the help of three important parameters. These are Fixed Obligation to Income Ratio (FOIR), Loan to Value Ratio (LTV) and Instalment Income Ratio (IIR). These parameters are indicators of your financial strength and repayment capabilities. Every bank and lending institution has its own policies and standards for evaluating home loan applications.

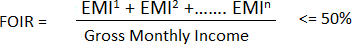

Fixed obligation to income ratio (FOIR): FOIR is the ratio of the sum of all your EMIs (current & proposed) to your gross monthly income. It is one of the popular parameters used by banks to determine your home loan eligibility amount.

Your fixed obligations do not include the statutory deductions such as Provident Fund, Professional Tax and Investment Deductions.

FOIR takes into account the portion of your monthly income that goes into paying all your EMIs (including your proposed new loan). Banks usually prefer a FOIR which is not more than 50%. This means that not more than 50% of your income should go into paying EMIs.

Loan to value ratio (LTV): LTV denotes the part of the property value that can be availed as the home loan from the banks. The LTV ratio is based on the size of the home loan sought and determines the maximum amount that can be sanctioned to a property buyer. Some banks include the stamp duty & registration costs while determining property value, some other banks exclude the government costs.

The Reserve Bank of India (RBI) mandates the LTV of 90% for home loans of ₹30 lakh or less. For home loans more than ₹30 lakh and up to ₹75 lakh, the RBI mandates an LTV of 80%. For home loans more than ₹75 lakh, the RBI mandates an LTV of 75%.

Instalment income ratio (IIR): IIR denotes the percentage of your income going into paying the EMI of your home loan. Banks usually use an IIR of 30% to 40% while determining your home loan eligibility. For example, if a bank uses an IIR of 40%, that means the portion of your monthly income going into paying EMI of your home loan should not exceed 40%.

Bank assessment for your home loan eligibility

Consider a scenario wherein the bank where you apply for home loan considers a FOIR of 50% of your total income. Out of 50%, 10% is going towards your Car Loan EMI.

So, the available FOIR for your home loan is 40% and if your monthly income is ₹100,000.

Income x FOIR

= Available cash flows towards all loan EMIs

= 100,000 x 40% = ₹40,000

Suppose the bank is giving you the loan with an EMI ₹805 per lakh @ 8.3% for 25 years. So, with FOIR of 40%, you can get a loan amount of

40,000/805 lakh = ₹49.6 lakh.

Considering the LTV of 80%, you are required to make a down payment of 20%, which is as below 80% = ₹49.6 lakh

20% = ₹12.4 lakh

Total Home Budget = ₹49.6 lakh + ₹12.4 lakh = ₹62 lakh

Cover

If there is a sudden drop in your family income or a sudden rise in the expenses for some unforeseen reasons, you should have enough cover to make all your EMI payments for a few months.