How to pay TDS for your new home

June 1, 2021 . Fundamentals Of Home Buying . 10 min readIn certain large transactions , the tax has to be deducted at the point of payment and paid to the government . Apart from the taxes that homebuyers pay, there is one more tax which they have to pay by deducting it from the amount paid to the developer That is tax deducted at source(TDS).

Why and when the TDS has to be paid?

Section 194IA of the Income Tax Act, 1961 states that 1% of the final value of the property has to be deducted by the buyer on the behalf of developer and to be paid to the Government. This is only applicable to the properties of the value of more than Rs.50 lakhs. This tax was introduced as an objective to collect it from the source of income of the developer.

TDS is deducted at the time of transaction when the final amount is to be credited in developer’s account. It is mandatory that , the buyer obtains the PAN of the developer while paying the TDS. Failing to provide the same will result in paying 20% of the final amount as TDS. The buyer pays it through the form 26QB. After the TDS is paid, buyer has to provide the TDS certificate which is in form 16B to the developer. This is procured with 10-15 days after the TDS payment.

Step by step guide to how to pay TDS online:

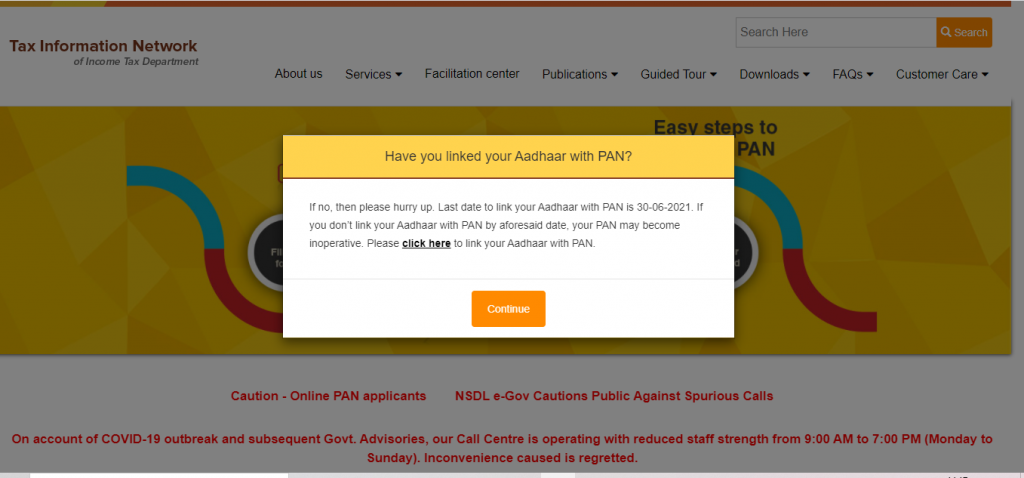

Step 1 Navigate to the TIN website

Login to http://www.tin-nsdl.com

As soon as you visit the site, a prompt will appear asking “Have you linked your Aadhaar with PAN” then click continue

After that another prompt of “Welcome to TIN website” of Income Tax Department authorization information notice, click continue.

One more prompt of “Attention PAN Card Applicants”, click continue or closing the window is also fine.

Step 2 Proceed to required section

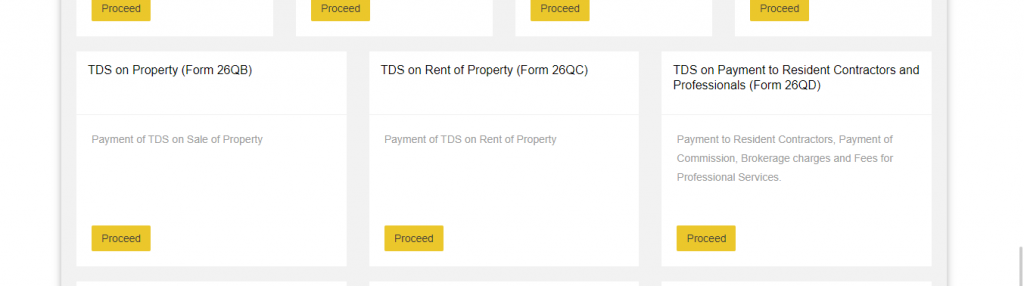

Go to the service tab in the top bar and then proceed by clicking on ‘e-payment-Pay taxes online’. A new window with different challans will open

Step 3 Navigate to TDS on property (Form 26QB)

Scroll down to the to find TDS on Property (Form 26QB).

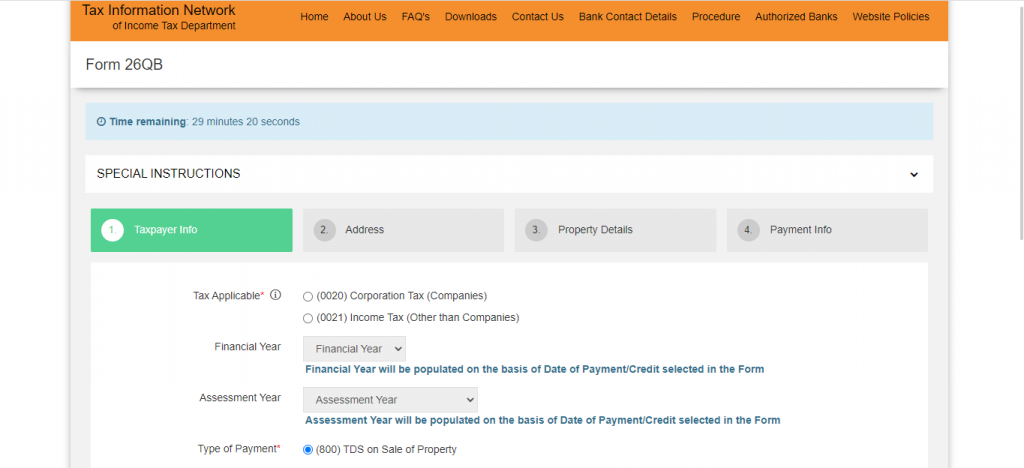

On clicking Proceed, the following window will appear:

Step 4 Enter the required details

If you are a corporate payer then select 0020 or else select 0021. Details like financial year, assessment year, type of payment, will be auto-populated. Thereafter fill in the required details like resident/non-resident status and PAN details of buyer and seller address of transferee as well as transferor, complete address of the property, the amount paid in figures and words, and tax amount to be deposited. . After all the property details have been entered, the homebuyer can finally proceed to the Payment info tab.

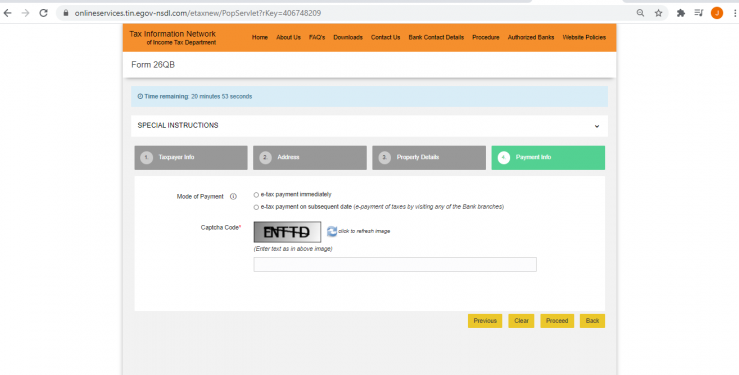

Step 5 Paying the TDS

On the payment info tab, payer will find 2 modes of payment, one is through net banking facility and other is to pay by visiting a bank branch from the specified list of banks.By choosing net banking, it takes the payer to the selected bank’s interface and post the payment, a challan 280 is generated with a tick on 800 indicating the payment of TDS on property sale which can be printed for future reference.

NOTE: If the homebuyer chooses to pay offline by visiting the bank’s branch, Form 26QB generates a unique Acknowledgment Number with a validity of 10 days. This has to be taken to the bank with the payment cheque so that the bank processes the payment and generates a challan.

Steps to obtain Form 16B:

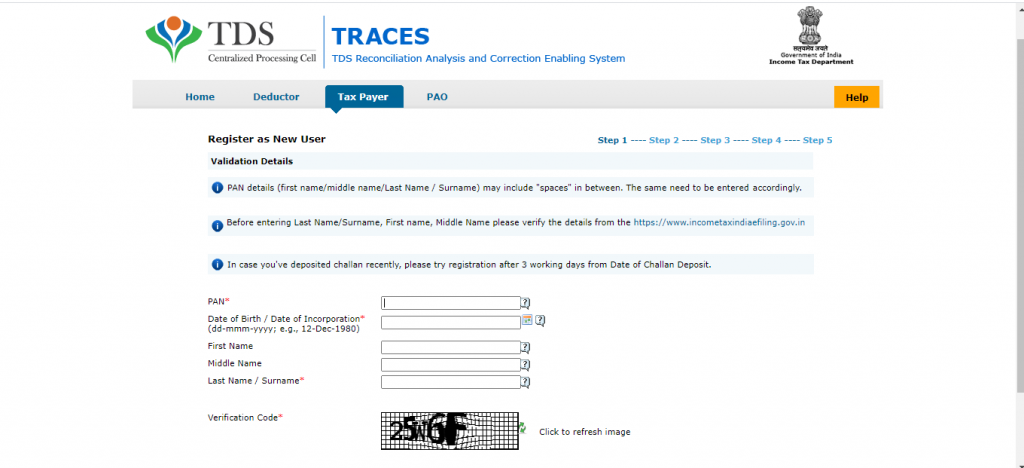

Step 1 Register on TRACES

For first time users, click here to register. After registration, approved Form 16B can be obtained and can be issued to the developer.

A week after payment, check Form 26AS and the payment is reflected under “Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA)”

The details like TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgment number (same as the one on your Form 26QB), date of deposit and TDS deposited are given by Part F.

Step 2 Navigate to Form 16B

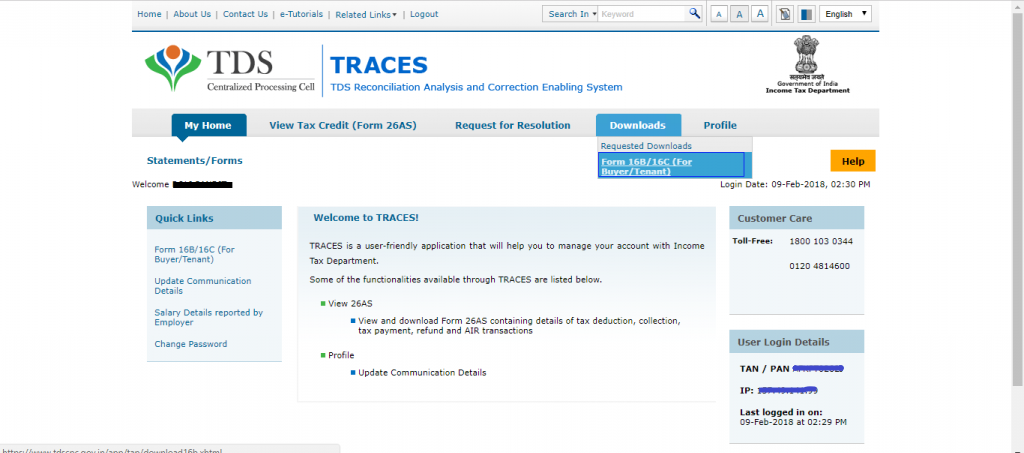

Once the payment is reflected on 26AS log onto TRACES portal, select the download tab and click on “Form 16B (for the buyer)”

Step 3 Enter details for Form 16B

Complete the process by filling the PAN of the developerand acknowledgement number details and click “Proceed”

Step 4 Verification and submission of details

Post verification of all the details entered click on “Submit a request”

Step 5 Download Form 16B

It will take few hours for the above request to be processed. Then select Form 16B in the Downloads tab in “Requested Downloads”. It appears as a downloadable zip file (pdf file inside) with password as date of birth of the Deductor in DDMMYYYY format. However, if the status of Form 16B appears as “submitted” then the same process has to be repeated after few hours.

Questions?

Should you any queries then feel free to write to us at [email protected]