In Maharashtra’s bustling real estate scene, owning a home can feel like a distant dream for many. However, the Maharashtra Housing and Area Development Authority (MHADA) offers a lifeline, providing affordable housing options through a transparent process. In this guide, we will meticulously navigate through the post-allotment journey of purchasing a MHADA home, breaking down each step to ensure clarity and understanding.

Step 1: Allotment Letter and Provisional Letter

Once you’re allotted a MHADA home, you’ll receive two crucial documents: the allotment letter and the provisional letter. These letters outline the stages of payment you’ll need to follow. The first payment, also known as the first installment, amounts to 25% of the property value and must be settled within 45 days from receiving the allotment letter.

Step 2: Payment of First Installment

The initial payment, amounting to a quarter of the total property cost, marks a crucial step for anyone purchasing a MHADA Home. Homebuyers are allowed a 15-day extension beyond the initial 45 days to complete the payment. It’s important to meet this deadline in order to avoid any penalties. However, if the deadline is not met, MHADA will levy a penalty, typically calculated as a percentage of the total amount. This percentage is subject to annual revision and may range around one percent on a monthly basis of your property cost.

Step 3: Second Installment Payment

After completing the first installment, the next crucial step is to pay the second installment, which covers the remaining 75% of the property value. MHADA provides a timeline of 60 days for this payment. Additionally, if you require more time, MHADA offers an extension of 90 days beyond the initial 60 days, summing up to a total duration of 150 days for completing the payment.

It’s essential to utilize this timeframe effectively to ensure a smooth payment process and avoid any penalties or complications. Buyers have two options here: pay the amount upfront or opt for a home loan. If you choose the latter, ensure timely approval to avoid any complications.

Step 4: Home Loan Approval Phase

For those opting for the home loan process, it’s imperative to initiate the approval phase during this timeframe to facilitate the purchase of a MHADA Home. Ensuring timely approval from your bank is essential, as the funds must be disbursed to MHADA within the stipulated duration. Failure to adhere to the timeline may result in penalties, typically ranging from 1 to 2 percent on a monthly basis, subject to annual revision. It’s crucial to monitor the progress closely and avoid exceeding the deadline to prevent incurring additional charges, which could be added to your second installment.

Step 5: Document Submission and Payment Process

- Accessing the MHADA Portal

Upon receipt of your provisional letter, users can easily log in to the MHADA portal using their PAN (Permanent Account Number) as their user ID. They have two options for authentication:

1. Password: Users can create a password for their account.

2. OTP (One-Time Password): Alternatively, users can opt for PAN-based authentication with OTP verification. The OTP is sent to the mobile number linked with their PAN for added security.

Once logged in, users can navigate the MHADA portal to complete the automated application process seamlessly.

- Uploading Essential Documents

You must log in to the MHADA portal using your PAN card and OTP verification to begin uploading the required documents, namely the allotment letter and the provisional letter.

- Payment Process and Options

After successfully uploading your documents, the next step is to proceed with the payment process. On choosing the payment option, you will be directed to an e-challan form. Fill in all the necessary details from your provisional letter, including the property address and scheme code. Once submitted, you will receive an e-challan receipt.

This receipt provides multiple payment avenues. If you have funds readily available, you can directly pay through net banking, offering a convenient and efficient option for buyers with online banking capabilities. Alternatively, if net banking isn’t feasible, you’ll need to obtain an eSBTR Challan. This e-receipt serves as authorization for payment at your bank. If cash payment is required, you’ll need to present this e-receipt to your bank, enabling them to process the payment on your behalf. This flexibility ensures that buyers can navigate the payment process seamlessly, regardless of their preferred payment method, ensuring a smooth transaction for your MHADA Home.

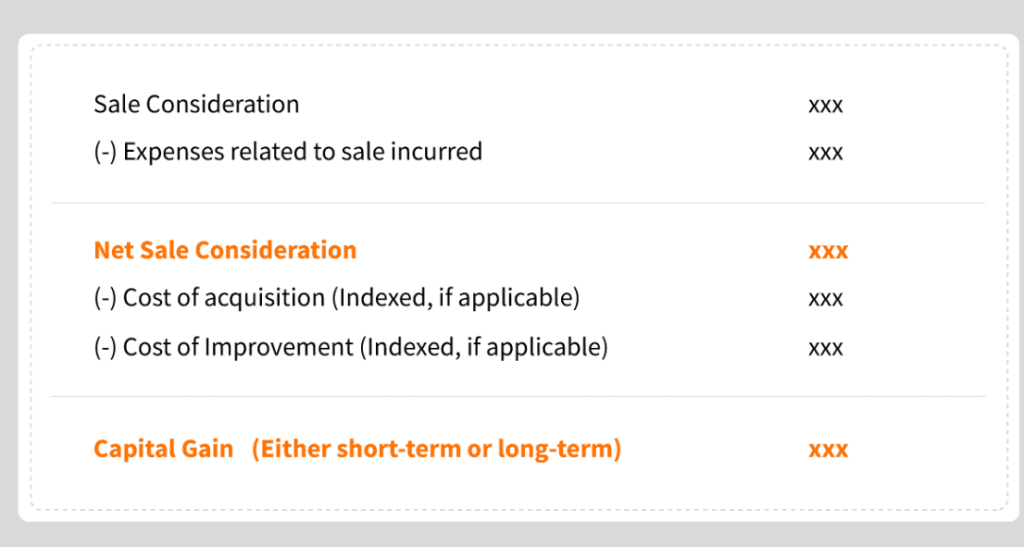

Step 6: TDS Payment

Once the initial payments for the installments are completed, there’s another crucial payment to be made – the Tax Deducted at Source (TDS), which essentially represents the property tax obligation. To initiate the TDS payment process, you’ll need to follow the same procedure as before. This entails generating a receipt through the MHADA portal and proceeding with the payment.

Expert guidance may be required when handling property tax matters, especially TDS. It is advisable to seek assistance from a Chartered Accountant (CA) for dealing with TDS payments. This is because it involves navigating the intricacies of the income tax portal. By consulting with a CA, you can ensure compliance with tax regulations and facilitate a smooth TDS payment process for your MHADA Home.

Step 7: Draft Allotment Letter and Document Verification

After completing all three payments, you’ll receive a crucial document known as the draft allotment letter. This letter serves as a confirmation of all the payments made, encompassing both installments and the TDS amount.

To proceed further, you’ll need to gather several documents for verification purposes. These include two passport-sized photographs, your Aadhaar card for identification, and if applicable, the necessary documents related to your home loan. Additionally, the MITC (Most Important Terms and Conditions) document, often provided by the bank, holds significant importance.

Armed with these essential documents, you’ll make your way to the MHADA office for the next steps in the verification process. This phase ensures that all payments and documentation align with MHADA’s requirements, bringing you one step closer to finalizing your MHADA home acquisition.

Step 8: Registration and Stamp Duty

- Document Submission and Verification at the MHADA Office

After gathering all the required documents, the next crucial step is to submit them to the MHADA office for verification. Once the documents are submitted, they proceed with the e-registration process, which involves both registration and stamp duty payment.

- Options for Processing Documents

At the MHADA office, you are presented with two options for processing your documents. The first option involves utilizing the services of an agent present at the office, who assists in completing the stamp duty and registration procedures for a nominal fee. Alternatively, you can choose to manage the process independently.

- Independent Document Processing

If you’re opting to manage the process yourself, the first step involves submitting all the necessary documents at the designated Head Office, typically located in Bandra, Mumbai. Here, the documents undergo thorough scrutiny, including an assessment of income and loan validation.

- Determination and Payment of Stamp Duty

Once the documents are verified, the stamp duty amount is determined. This amount, typically a substantial sum, is paid through the bank. You need to generate a receipt from the MHADA Head Office, which serves as proof of payment for stamp duty.

- Collection of Documents and Agreement

Following the stamp duty payment, you must collect all the documents, including a separate agreement, along with the necessary documents, which must then be taken to the registrar’s office for further processing.

- Property Registration at Registrar Office

At the registrar’s office, two crucial actions take place. Firstly, MHADA provides the property agreement, confirming the details of your property ownership. Secondly, the registration office authenticates the property registration by affixing a registration stamp. This stamp verifies your property’s official registration and validation by a registrar.

Step 9: Finalizing Registration at Registrar’s Office

After obtaining the property agreement, your next step is re-visiting the registrar’s office. The timing of this visit is flexible, depending on your convenience.

Once you decide to go to the registrar’s office, you’ll need to access your account. There, you’ll find a link guiding you through the process and directing you to the nearest registrar’s office. Submit the agreement along with the required documents.

Additionally, there’s a small yet essential step called Data Entry Note. To complete this, you’ll need to engage a lawyer. They’ll compile all necessary information onto a single page summarizing your property acquisition process. The applicant needs to submit the agreement, PAN copy, and Aadhaar card copy along with the Data Entry Note to get the Index 2 document from the registrar’s office. Typically, there is a fee of ₹1500 for this service.

Once all documents are submitted to the registrar’s office, the final step of the registration process is to complete, formalizing your ownership of the MHADA property.

Step 10: Final Verification and Key Collection

After submitting all documents to the registrar, there will be a verification process that typically takes 1 to 2 hours. Upon successful verification, you’ll receive an index copy along with the property agreement. With these documents in hand, your agreement process is effectively completed. The next step involves returning to the MHADA Head Office, where you’ll present the agreement and index copy for final verification. Once authenticated, you’ll receive a receipt crucial for obtaining the keys to your property.

Subsequently, proceed to your property site, where you’ll connect with a MHADA representative or office nearby. Present the receipt to them, and after verification, you’ll be handed the keys to your new property, marking the completion of the entire process for your MHADA Home.

Step 11: Commencing Loan Payments

For those with a home loan, it’s crucial to kickstart EMI payments promptly. Initially, you’ll only need to cover the pre-EMI, which includes the interest, for the first two months. The actual EMI payments begin after submitting the final agreement to the bank.

After getting the keys, swiftly hand over the agreement and index copy to the bank. This ensures that your EMI schedule starts from the following month. Remember, delaying this step means you’ll keep paying interest without reducing the loan principal. So, act promptly to stay financially on track with your MHADA Home.

Conclusion:

Navigating the process of purchasing a MHADA property involves several crucial steps, from initial allotment to final registration and key collection. Each stage demands meticulous attention to detail, from document submission to ensuring the timely initiation of loan payments. With a clear understanding of the process and diligent adherence to each step, prospective buyers can successfully navigate the journey towards owning their dream MHADA home. Remember, MHADA homes stand as symbols of hope and opportunity, making homeownership a tangible reality for many individuals across Maharashtra.